Introduction

At the beginning of 2021, there was some uncertainty regarding how the hardening insurance market would impact broker-dealers. Broker-dealer Errors & Omissions (E&O) insurance is typically the primary insurance cost driver for firms. For the most part, broker-dealer E&O has been shielded from industry-wide hardening market shifts. This is due primarily to the fact the domestic and international equities have continued their march upward. Rising stock markets generally mean brokerage customers are less likely to sue their advisors. Also, the premium for broker-dealer E&O insurance is almost exclusively driven by loss ratios of each specific client and has less to do with overall hardening insurance markets. So, firms live and die by their own claim history, and for the last five years, most firms have had historically low claim volumes. These factors notwithstanding, 2021 still proved to be challenging for firms in other ways. Below is a summary of some of the headwinds we are currently facing and how they may influence the market conditions for broker-dealers in 2022.

What we saw in 2021

2021 insurance coverages for broker-dealers impacted by hardening insurance market.

- Cyber Insurance: Cyber continues to be the most challenging placement for broker-dealers, the same as we are seeing in other industry sectors. Broker-dealers are experiencing increases of 50% and higher coupled with increased retentions as well as reductions in limits. The main underwriting factor for broker-dealers is how advisors are managing cybersecurity in the field. A large focus has been on their multi-factor authentication in place for remote access. Also, any measures the firm has taken to train their advisors to mitigate risk of loss from ransomware is critical to renewal pricing.

- Management Liability Insurance (Directors & Officers, Employment Practices Liability and Fiduciary Liability): For broker-dealers, management liability lines were impacted by the hardening market and firms typically will see the same types of changes in the general marketplace. In 2021, we saw moderate increases of 10%-15% on these lines. Directors & Officers (D&O) for broker-dealers continues to be challenging from a primary basis, and generally, placement of the D&O rests heavily on the placement of the primary E&O.

Current state of the market

Errors & Omissions (E&O):

In the E&O marketplace, 2021 remained favorable for firms with good loss experience. After years of a soft market, we are not seeing premium reductions as often as we've seen in prior years. However, we may see a new carrier enter this space in the near future. Any new entrants (all things being equal) should resume the pressure on incumbent markets to decrease price and/or improve coverage going forward.

Finding coverage for small broker-dealers continues to remain a challenge. Insurer capacity has reduced significantly for small firms, and we do not forecast a change to this any time soon. We have not seen any major changes to coverage or limits for our larger broker-dealer clients. However, we need to focus on a few areas of coverage when reviewing coverage at the renewal, such as cryptocurrency.

Investing in cryptocurrency continues to be a topic of interest. According to CoinMarketCap in November 2021, 1 the market cap for cryptocurrency was $2.62 trillion. Through the years, we have seen some of our firms and their advisors investing their clients' assets in some forms of cryptocurrency. Bitcoin is the most widely known, but there are a multitude of other crypto options. Our clients are generally not allowing their advisors to sell cryptocurrency directly, but many are now allowing client investments in exchange traded funds (ETFs). These ETFs can be bought and sold like any other stock. Some ETFs, in particular, mimic the valuations of Bitcoin or other cryptocurrencies. We are watching this trend continue and when it comes to E&O insurance, you should be on the lookout for the following.

- Policy Exclusions: Look for any explicit exclusions regarding cryptocurrency or bitcoin. We have seen carriers include a full cryptocurrency exclusion. With any exclusion, it is critical to review this language and determine whether or not it would apply to any funds or ETFs with cryptocurrency holdings, especially if these products are on the firms' approved product list.

- Regulatory Changes: The SEC did not have cryptocurrency regulation on their 2021 priorities2 however, that can change in 2022. With that change, you can see an increased number of claims and customer complaints.

Fidelity:

Fidelity bonds have always been a challenging line of coverage for broker-dealers. Severe losses continue to limit available insurance carriers willing to take on this distressed class of business. As a result, we saw broker-dealers take increased retentions and/or increased pricing to offset those severe losses. Placing the fidelity bond with the same carrier as the firm's E&O can offset or reduce the impact of the increasing fidelity costs.

Social engineering fraud continues to be a hot-button issue for many clients. Most broker-dealer firms require their advisors to verify any funds transfer request with a call to the client. Still, we continue to see claims where the callback procedure was not adequately followed or even scenarios where the fraudster deceives employees or advisors into thinking they are the client contact. While we typically look for the bond policy to cover this exposure, we also see carriers putting limited coverage on the E&O policies with small sub-limits and at lower retentions than the bond policy. There is a potential to also find some coverage on the Cyber policy, but we see less of this recently, especially in light of the hardening Cyber market and carriers are reluctant to offer this coverage for broker-dealers (or other large financial institutions). However, if the coverage is found on multiple policies, it is important that we evaluate the policies and the other insurance clause so we have a clear picture on the limits and retention would apply. The goal is for the insured only to have a single retention.

Ongoing COVID-19 Impact:

One impact we saw that the COVID-19 pandemic had on broker-dealers was a slowdown in recruitment or M&A activity. General uncertainty on how top line revenue would be impacted by the shift to working from home, led to a drastic decrease in broker-dealers recruiting or firms looking to buy and/or sell. Most recently, we started to see a shift to more in-person conferences and other live events, and recruitment has begun to increase. According to Investment News, Advisors on the Move data3 recruitment is still 10% below where it was pre-pandemic level.

M&A activity began to pick up midway through 2021 as well. Private equity-owned broker-dealers are looking for ways to grow assets and advisor count with aggressive growth targets quickly.

We expect this trend to continue through 2022. M&A deals present their own insurance challenges to tailor the insurance program to fit each individual transaction, particularly the E&O and fidelity bond. Working with your Gallagher team early on in the process allows us to evaluate existing coverage and offer options to transfer that risk as part of the transaction or roll the liability into another E&O policy. Advisors rely on this insurance to conduct their business, and often these transactions leave out the reps past liability (or prior acts). We evaluate this exposure early on. As part of our review, we ensure any past claims or any troubled products are being effectively covered by insurance when firms buy or bring on new advisors.

Real Estate Investment Trusts (REITs):

COVID-19 impacted the commercial real estate market, and other real estate and REIT sectors. REIT investment performance has varied, with certain sectors getting hit harder than others, causing some to suspend distributions. The reality of this change in investment performance for REITs is that there are plaintiff firms with national practices who utilize online advertising in order to solicit complaints from clients of broker-dealers, regardless of whether or not the underlying assets will recover with time. With that, you can expect to see a change in loss frequency involving REITs as these firms are using this as an opportunity to solicit business.

- The number one type of security in customer arbitrations filed through September was REITs.

- 357 cases involving REITs were filed through September 2021.4

FINRA Arbitration Statistics:

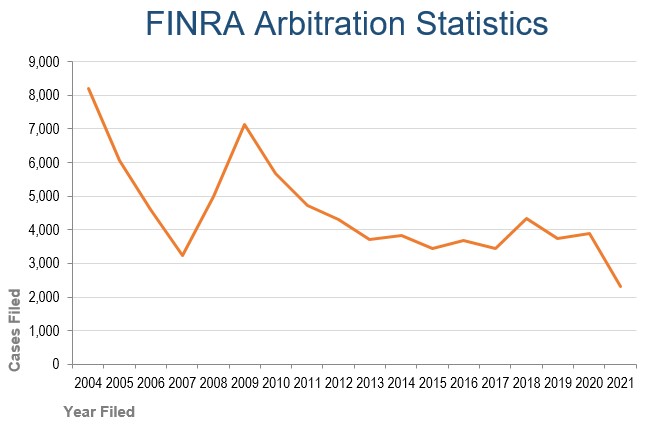

Though not a perfect measure, FINRA arbitration data can give us valuable insight into the claims trend of the industry as a whole. A booming economy has provided ample returns for clients, which in turn has led to depressed arbitration and claims activity over the past six years. In 2020, we saw some market volatility as well as a slight increase in the number of arbitrations filed, however, it is currently trending down 17%.4 The return of volatility to the market can lead to an increase in claims frequency across the industry.

https://www.finra.org/arbitration-mediation/dispute-resolution-statistics

Looking ahead

As we move into 2022, we will continue to watch changes to the below and any impact it may have on coverage.

- M&A activity: We will continue to monitor clients' M&A activity and/or an increase in recruitment and evaluate the impact on coverage. Any increase or changes to the risk profile can lead to an increase in cost on a per rep basis for the broker-dealer.

- Market volatility: If we see poor performance of the equity markets in 2022, this will be the primary driver of claim activity. Any changes to investments sold by broker-dealers and any changes to claims activity around these products.

- Regulatory changes: We will monitor any new regulatory changes and priorities that can impact coverage and pricing for 2022.

We will keep a close eye on how all these factors play out and impact individual loss experience, which will determine the outlook in 2022 for E&O and Fidelity Bond.

Conclusion

Based on the highly nuanced nature of this market and the broker-dealer, it is imperative that you are working with an insurance broker who specializes in your particular industry or line of coverage. Gallagher has a vast network of specialists that understand your industry and business, along with the best solutions in the marketplace for your specific challenges. It is extremely important to start renewals as soon as possible, work with your Gallagher team with dedicated expertise in this space to deliver a comprehensive and professional submission to underwriters.

Please note: A client's risk profile is the primary variable dictating renewal outcomes. Loss experience, industry, location and individual account nuances will also have a significant impact on these renewals.

Sources:

1 Cryptocurrency Prices, Charts And Market Capitalizations | CoinMarketCap

2 https://www.sec.gov/files/2021-exam-priorities.pdf

3 Adviser recruiting stays cold while breakaway RIAs heat up - InvestmentNews